Mail.Ru Group Limited Preliminary Trading Statement for the Full Year 2015

OREANDA-NEWS. Mail.Ru Group Limited (LSE: MAIL, hereinafter referred as "the Company" or "the Group"), one of the largest companies in the Russian-speaking Internet market, today provides the following preliminary unaudited segment financial information and key operating highlights for the full year ended 31 December 2015.

FY 2015 Performance Highlights

Excluding HeadHunter

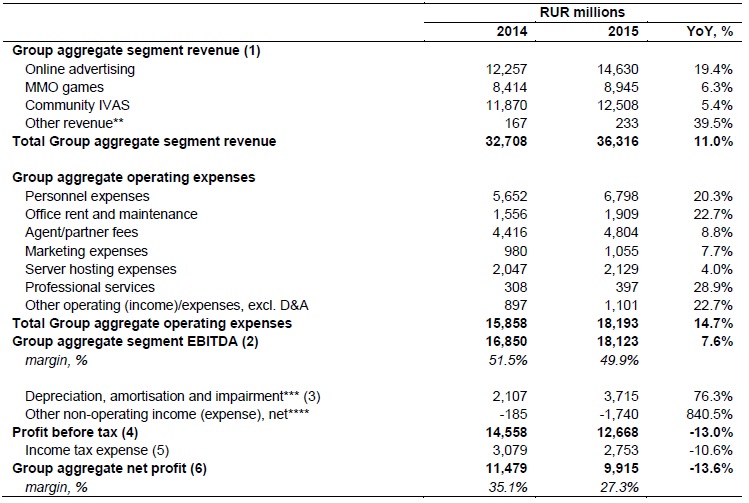

- FY 2015 Group aggregate segment revenue grew 11.0% Y-o-Y to RUR 36,316 million

- FY 2015Group aggregate segment EBITDA grew 7.6% Y-o-Y to RUR 18,123 million

- FY 2015 Group aggregate net profit decreased by 13.6% Y-o-Y to RUR 9,915 million

Including HeadHunter

- FY 2015 Group aggregate segment revenue grew 10.0% Y-o-Y to RUR 39,343 million

- FY 2015Group aggregate segment EBITDA grew 6.7% Y-o-Y to RUR 19,623 million

- FY 2015 Group aggregate net profit decreased by 11.5% Y-o-Y to RUR 11,110 million

Net debt position ex HeadHunter as of 31 December 2015 was RUR 6,888 million (excluding interest payable of RUR 101 million)

Mail.Ru Group is the leading online property in Russia with 77.1 million monthly active users (comScore MMX Multi-Platform, Russia, age 6+, December 2015)

Key recent developments

- Concluded sale of HeadHunter to consortium led by Elbrus Capital for RUR 10bn

- Worldwide launch of in-house mobile games Evolution: Heroes of Utopia and Juggernaut Wars (on iOS & Android)

- Release of two add-ons for Warface: Cyber Horde and Earth Shaker

- myMail and Mail.Ru apps for iOS and Android updated with conversation threads, advanced search, ability to undo actions with messages (iOS only), ‘Mail to Self’ share extension and ‘do not disturb’ option

- MAPS.ME apps for iOS and Android updated with voice navigation, point-to-point navigation, 3D objects and night mode

- ICQ for iOS and Android updated with voice messages with speech-to-text recognition, ‘raise to listen’ feature for audio messages (Android only) and multiple performance and UI improvements of video calls

- ICQ was given Editors’ Choice and Top Developer awards in Google Play

- VK launched messages in groups (communication tool for groups especially for businesses allowing for client support via VK)

- VK launched VK University which offers offline courses to learn programming languages

- Multiple updates of VK apps for iOS and Android

- Multiple updates of messaging service in OK.RU

- myTarget launched hyper local geo ads

- Mail.Ru Group launches new Big Data business unit focused on services related to predictive mathematical models, marketing research, consulting on infrastructure development and methodology

- OK.RU and MAPS.ME apps listed among the best apps of 2015 on Google Play

Commenting on the results of the Group, Dmitry Grishin, Chairman and CEO (Russia) of Mail.Ru Group, said:

In FY 2015, the Company achieved Y-o-Y revenue growth of 10.0% to RUR 39,343 million with H2 2015 Y-o-Y revenue growth of 12.8%. This revenue and growth rates are based on a full pro-forma consolidation of VK from the beginning of 2014 and include HeadHunter for the FY 2015. Ex HeadHunter full year revenue growth would have been 11.0% to RUR 36,316 million. The macro and FX backdrop to 2015 clearly created more challenging trading conditions than in previous years. However we are pleased to have delivered solid progress in all areas. With good management of our cost base, and the start in growth of our international revenues, we have managed to offset most of the margin impact from the ruble devaluation. As such EBITDA (ex HeadHunter) grew 7.6% Y-o-Y to RUR 18,123 million with 49.9% EBITDA margins which were close to the levels seen in 2014.

Despite the tough backdrop overall advertising revenues (ex HeadHunter) grew 19.4% Y-o-Y to RUR 14,630 million in FY 2015. While visibility remains unchanged we saw improved demand during the second half of the year with revenues (ex HeadHunter) increasing 27.5% Y-o-Y to RUR 8,333 million in H2 2015. This was mainly driven by targeted advertising, especially mobile and VK where we saw good demand, and traction with both users and advertisers remains strong. During H2 2015 we also saw improvement in display revenues. 2016 has had a solid start in advertising and while visibility is still limited we expect good growth in this area.

2015 saw the continued focus on games with the domestic and international releases of both Skyforge and Armored Warfare. Skyforge has had a solid start, and continues to see growth in both revenues and users. The initial feedback on Armored Warfare has been very encouraging both domestically and internationally with a domestic marketing campaign in late Q4 2015 and early Q1 2016 being very well received and leading to strong growth in user numbers. We will be undertaking a number of similar international marketing campaigns through 2016. Armored Warfare has now more than 5m registered users. Near term focus will remain on building the user base, rather than monetisation.

World of Speed has seen some further delays in development, as such we have taken a one-time, non-cash impairment charge of RUR 1,338 million against its development. Overall, MMO games revenues grew 6.3% Y-o-Y to RUR 8,945 million in FY 2015 with H2 2015 growth of 10.9% Y-o-Y to RUR 4,814 million. During 2016 we have a number of mobile titles scheduled for release. Based on the continued success of the already released games and the pipeline, MMO games is expected to show solid growth in 2016.

We have previously commented that FX volatility and increased mobile use continues to affect our ability to increase IVAS monetisation. As a result of this, FY 2015 IVAS grew 5.4% Y-o-Y to RUR 12,508 million with H2 growth of 0.1% Y-o-Y to RUR 6,142 million. We continue to remain focused on increasing user engagement and improving our product, especially on tuning IVAS mechanics on mobile, and hence increasing paying user penetration. However with current FX volatility we expect to see IVAS revenues in 2016 broadly in line with 2015.

2015 represented the first full year of VK ownership. The integration process is now well advanced and will be largely completed in 2016. Through the year the team continued to execute well with FY revenue growth of 44.2% Y-o-Y and H2 revenue growth of 52.8% Y-o-Y. Engagement and audience continued to see good growth with MAU reaching nearly 90m for the first time in January 2016, and over 70% accessing via mobile devices. We continue to see a number of opportunities for VK and the focus in 2016 will continue to be on advertising and particularly in mobile and native advertising, where we have seen very strong growth over the last year. Additionally we will be launching new features and products through the year. As such we expect to see growth in 2016 continue at a strong pace.

As we also announced this morning we are pleased that we have finalised the sale of HeadHunter to an investor consortium led by Elbrus Capital for RUR 10bn. The cash will be paid in 2 tranches by the end of April 2016. With ex HeadHunter net debt of RUR 6,888 million at the end of FY 2015 we will therefore move into a net cash position by the end of April 2016.

As previously commented we were pleased with the 2015 margin performance. In H2 we saw a further deterioration in the RUR and hence going into 2016 the average RUR FX rate looks likely to be lower than 2015. We have previously commented that our main USD costs are Moscow office rent, hardware and some international salaries. Historically, the largest of these has been the office rent. We are pleased to announce that in late Q4 we signed a new agreement on the Moscow office with the FX rate fixed for the period of the lease at a level similar to our previous agreement. This is in return for some upfront rent payments in Q4 2015 and Q1 2016. As a result of this agreement we do not expect to see any rises in rent as a percentage of revenues over the next few years. We continue to focus on cost management and better utilisation of hardware, and hence expect capex to remain broadly at around the same level, as a percentage of revenues, as we have had over the last few years.

While the continued challenging macro environment and FX headwinds present challenges we are pleased with the solid FY 2015 performance. We are encouraged by the growth in advertising, especially on myTarget, and continue to see a number of exciting opportunities. We have had a solid start to 2016 and based on current visibility and current market conditions, we expect ex HeadHunter like for like FY 2016 revenue growth to be between 8%-14%. While we will be undertaking further marketing campaigns through 2016, we continue to maintain effective cost management, and are pleased that we have offset the main FX exposure in our costs, as such we anticipate full year EBITDA margins at between 47-49%.

Conference call

The management team will host an analyst and investor conference call at 9.00 UK time (12.00 Moscow time), on Friday 26th February 2016, including a Question and Answer session.

To participate in this conference call, please use the following access details:

Confirmation Code: 45780992

Participant Toll Free Telephone Numbers:

From Russia 810 800 2097 2044

From the UK 0844 871 9434

From the US 1866 434 1089

Cautionary Statement regarding Forward Looking Statements

This press release contains statements of expectation and other forward-looking statements regarding future events or the future financial performance of the Group. You can identify forward looking statements by terms such as "expect", "believe", "anticipate", "estimate", "forecast", "intend", "will", "could", "may" or "might", the negative of such terms or other similar expressions including "outlook" or "guidance". The forward-looking statements in this release are based upon various assumptions that are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and may be beyond the Group's control. Actual results could differ materially from those discussed in the forward looking statements herein. Many factors could cause actual results to differ materially from those discussed in the forward looking statements included herein, including competition in the marketplace, changes in consumer preferences, the degree of Internet penetration and online advertising in Russia, concerns about data security, claims of intellectual property infringement, adverse media speculation, changes in political, social, legal or economic conditions in Russia, exchange rate fluctuations, and the Group's success in identifying and responding to these and other risks involved in its business, including those referenced under "Risk Factors" in the Group's public filings. The forward-looking statements contained herein speak only as of the date they were made, and the Group does not intend to amend or update these statements except to the extent required by law to reflect events and circumstances occurring after the date hereof.

About Mail.Ru Group

Mail.Ru Group (LSE:MAIL, listed since November 5, 2010) is a leading Internet company in Europe and the fifth largest Internet business globally, based on the total time spent (comScore, top 100 properties, December 2015, worldwide).

In line with the ‘communitainment’ (communication plus entertainment) strategy, the Company is developing an integrated communications and entertainment platform. The Company owns Russia’s leading email service and one of Russia’s largest internet portals, Mail.Ru. The Company operates three of the major Russian language social networks, VKontakte (VK), Odnoklassniki (OK) and Moi Mir (My World), and Russia's largest online games business. The Company’s portfolio also includes Mail.Ru Agent and ICQ – two instant messaging services popular in Russia and the CIS.

The Company holds a minority equity stake in Qiwi (1.31%) and a number of small venture capital investments in various Internet companies in Russia, Ukraine and Israel. In November 2013, the Company launched My.com in the US followed by the worldwide launch to provide communication and entertainment products and services.

Group Aggregate Segment Financial Information (ex HeadHunter)*

Note: Group aggregate segment financial information for the years ended December 31, 2014 and 2015 has been retrospectively adjusted to include pro-forma consolidation of VK and ICVA and deconsolidation of HeadHunter from January 1, 2014

(*) The numbers in this table and further in the document may not exactly foot or cross-foot due to rounding

(**) Including Other IVAS revenues

(***) Including impairment of intangible assets of RUR 0 and 1,397 million in 2014 and 2015 respectively

(****) Including interest expenses of RUR 767 and 2,326 million in 2014 and 2015 respectively

(1) Group aggregate segment revenue is calculated by aggregating the segment revenue of the Company's operating segments and eliminating intra-segment and inter-segment revenues. This measure differs in significant respects from IFRS consolidated net revenue. See "Presentation of Aggregate Segment Financial Information" below.

(2) Group aggregate segment EBITDA is calculated by subtracting Group aggregate segment operating expenses from Group aggregate segment revenue. Group aggregate segment operating expenses are calculated by aggregating the segment operating expenses (excluding the depreciation and amortisation) of the Company's operating segments including allocated Company’s corporate expenses, and eliminating intra-segment and inter-segment expenses. See "Presentation of Aggregate Segment Financial Information".

(3) Group aggregate depreciation, amortisation and impairment expense is calculated by aggregating the depreciation and amortisation expense of the subsidiaries consolidated as of the date hereof, excluding amortisation and impairment of fair value adjustments to intangible assets acquired in business combinations.

(4) Profit before tax is calculated by deducting from Group aggregate segment EBITDA Group aggregate depreciation, amortisation and impairment expense and adding/deducting Group aggregate other non-operating incomes/expenses primarily consisting of interest income on cash deposits, interest expenses, dividends from financial and available-for-sale investments and other non-operating items.

(5) Group aggregate income tax expense is calculated by aggregating the income tax expense of the subsidiaries consolidated as of the date hereof. Group aggregate income tax expense is different from income tax as would be recorded under IFRS, as (i) it excludes deferred tax on unremitted earnings of the Company's subsidiaries and (ii) it is adjusted for the tax effect of differences in profit before tax between Group aggregate segment financial information and IFRS.

(6) Group aggregate net profit is the (i) Group aggregate segment EBITDA; less (ii) Group aggregate depreciation, amortisation and impairment expense; less (iii) Group aggregate other non-operating expense; plus (iv) Group aggregate other non-operating income; less (v) Group aggregate income tax expense. Group aggregate segment net profit differs in significant respects from IFRS consolidated net profit. See "Presentation of Aggregate Segment Financial Information".

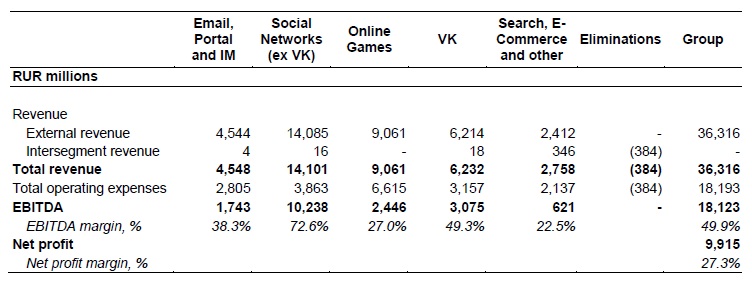

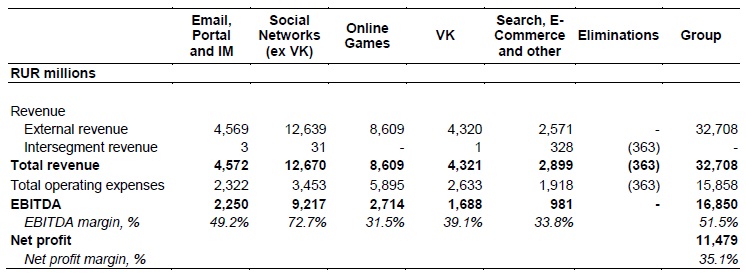

Operating Segments

We identify our operating segments based on the types of products and services we offer. We have identified the following reportable segments on this basis:

- Email, Portal and IM;

- Social Networks (excluding VK);

- Online Games;

- VK;

- Search, E-Commerce and Other Services

The Email, Portal and IM segment includes email, instant messaging and portal (main page and content projects). It earns almost all revenues from display and context advertising.

The Social Networks (excluding VK) segment includes our two social networks (OK.RU and My World) and earns revenues from (i) user payments for virtual gifts, (ii) revenue sharing with application developers, and (iii) online advertising, including display and context advertising.

The Online Games segment includes online gaming services, including MMO, social and mobile games. It earns almost all revenues from (i) sale of virtual in-game items to users and (ii) royalties for games licensed to third-party online game operators.

The VK segment includes the Company’s social network Vkontakte (VK.com) and earns revenues from (i) commission from application developers based on the respective applications’ revenue, (ii) user payments for virtual gifts and stickers, and (iii) online advertising, including display and context advertising.

The Search, E-Commerce and Other Services segment primarily consists of search engine services earning almost all revenues from context advertising, e-commerce and related display advertising. This segment also includes a variety of other services, which management considers insignificant for the purposes of performance review and resource allocation.

Each segment's EBITDA is calculated as the respective segment's revenue less operating expenses (excluding depreciation and amortisation and impairment of intangible assets), including our corporate expenses allocated to the respective segment.

Operating Segments Performance – FY 2015 (ex HeadHunter)

Note: Group aggregate segment financial information for the year ended December 31, 2015 has been retrospectively adjusted to include pro-forma consolidation of VK and ICVA and deconsolidation of HeadHunter from January 1, 2015

Operating Segments Performance – FY 2014 (ex HeadHunter)

Note: Group aggregate segment financial information for the year ended December 31, 2014 has been retrospectively adjusted to include pro-forma consolidation of VK and ICVA and deconsolidation of HeadHunter from January 1, 2014

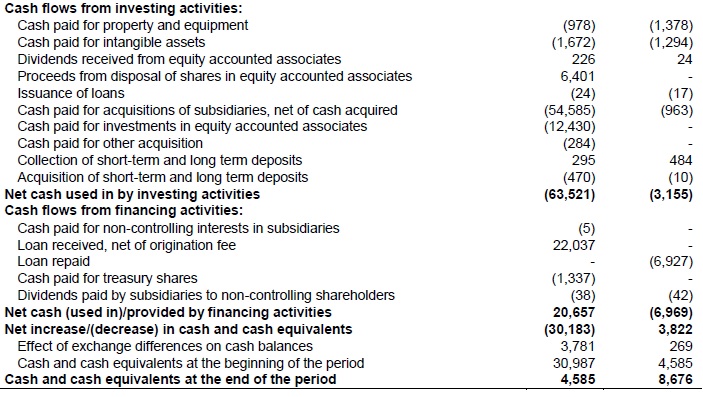

Liquidity

On ex HeadHunter basis, as of 31 December 2015 the Company had RUR 8,318 million of cash (including term deposits) and RUR 15,206 million of debt outstanding (excluding interest payable of RUR 101 million), therefore the Company's net debt position was RUR 6,888 million.

Replacement of Director

Following the resignation of Verdi Israelian from the board of Mail.Ru Group Limited Boris Dobrodeev has been appointed as his replacement with immediate effect.

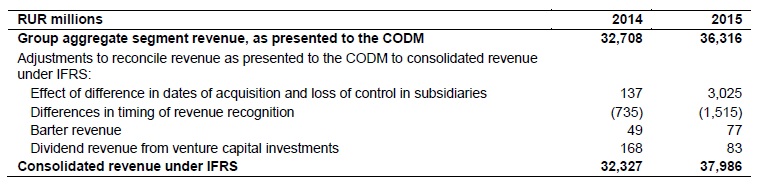

Presentation of Aggregate Segment Financial Information

The Group aggregate segment financial information is derived from the financial information used by management to manage the Company's business by aggregating the segment financial data of the Company's operating segments and eliminating intra-segment and inter-segment revenues and expenses. Group aggregate segment financial information differs significantly from the financial information presented on the face of the Company's consolidated financial statements in accordance with IFRS. In particular:

- The Company's segment financial information excludes certain IFRS adjustments which are not analysed by management in assessing the core operating performance of the business. Such adjustments affect such major areas as revenue recognition, deferred tax on unremitted earnings of subsidiaries, share-based payment transactions, disposal of and impairment of investments, business combinations, fair value adjustments, amortisation and impairment thereof, net foreign exchange gains and losses, share in financial results of associates, as well as irregular non-recurring items that occur from time to time and are evaluated for adjustment as and when they occur. The tax effect of these adjustments is also excluded from segment reporting.

- The segment financial information is presented for each period on the basis of an ownership interest as of the date hereof and consolidation of each of the Company's subsidiaries, including for periods prior to the acquisition of control of the entities in question, so long as the Company held at least one share of such entities during such periods. The financial information of subsidiaries disposed of prior to the date hereof is excluded from the segment presentation starting from the beginning of the earliest period presented.

- Segment revenues do not reflect certain other adjustments required when presenting consolidated revenues under IFRS. For example, segment revenue excludes barter revenues and adjustments to defer online gaming and social network revenues under IFRS.

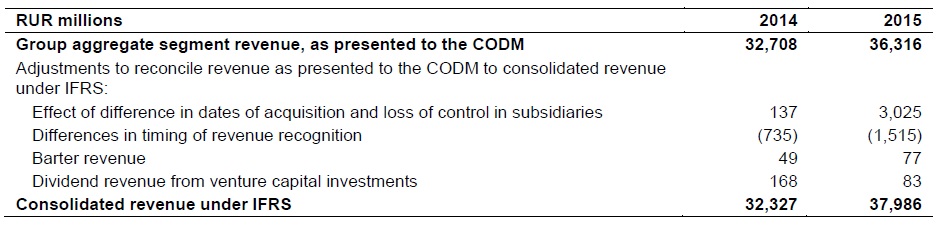

A reconciliation of Group aggregate segment revenue (ex HeadHunter) to IFRS consolidated revenue of the Company for the years ended 31 December 2014 and 2015 is presented below:

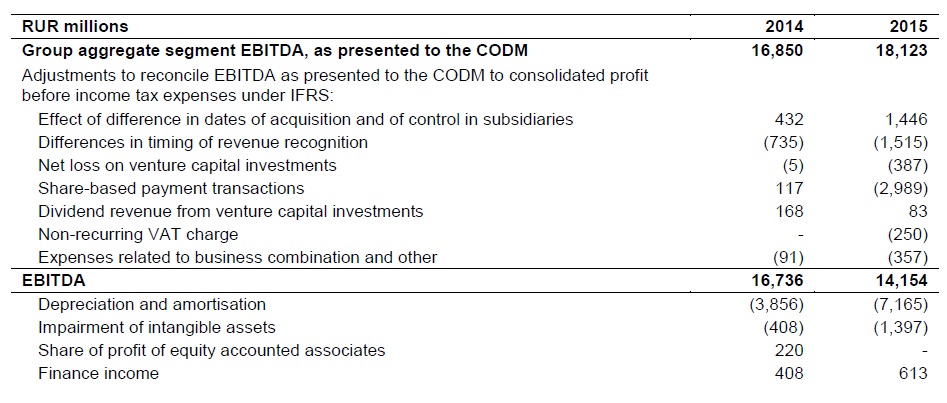

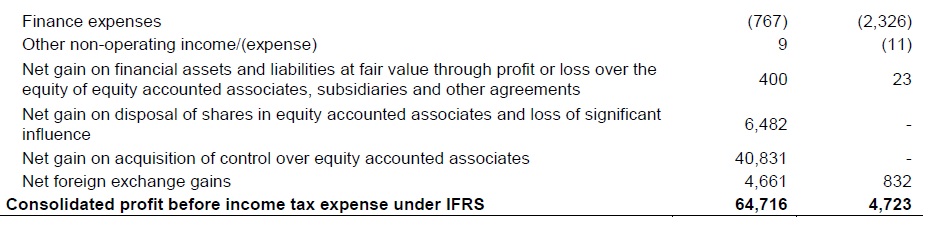

A reconciliation of Group aggregate segment EBITDA (ex HeadHunter) to IFRS consolidated profit before income tax expense of the Company for the years ended 31 December 2014 and 2015 is presented below:

A reconciliation of Group aggregate segment EBITDA (ex HeadHunter) to IFRS consolidated profit before income tax expense of the Company for the years ended 31 December 2014 and 2015 is presented below:

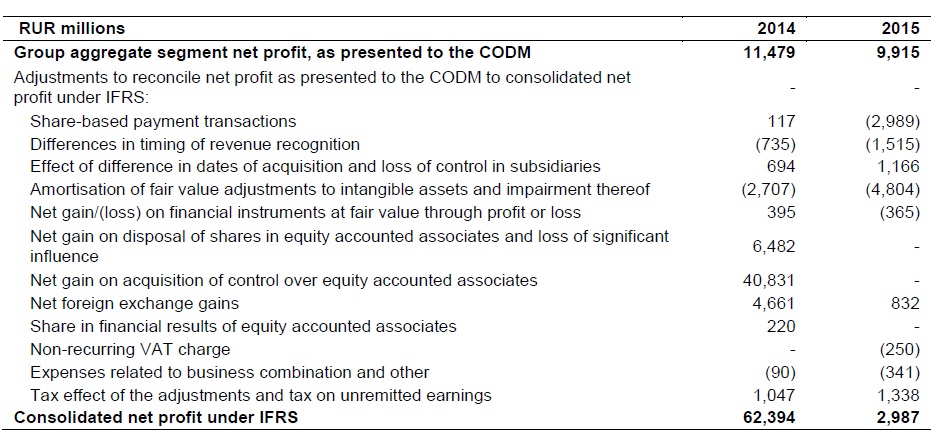

A reconciliation of Group aggregate net profit (ex HeadHunter) to IFRS consolidated net profit of the Company for the years ended 31 December 2014 and 2015 is presented below:

Selected Operating Statistics

- Mail.Ru Group is the leading online property in Russia with 77.1 million monthly active users (comScore MMX Multi-Platform, Russia, age 6+, December 2015)

- Mail.Ru Group is holding the lead in Russian mobile internet with 9.7 million mobile daily active users (TNS, Russia, cities 700k+, age 12-64, unique mobile users, December 2015)

- MMO average monthly payers amounted to 569 thousand users in H2 2015 (the numbers combine paying users of individual MMO games and may include overlap)

- Community IVAS average monthly payers amounted to 7,969 thousand users in H2 2015 (the numbers combine paying users of VK, OK.RU, My World, love.mail.ru and our own social games on third-party networks and may include overlap)

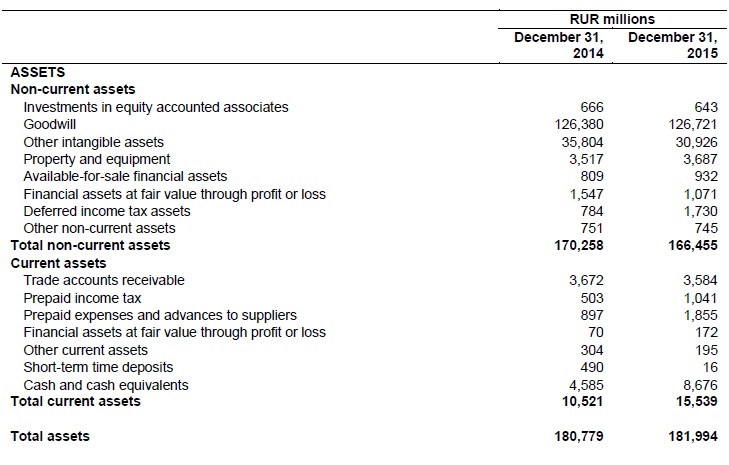

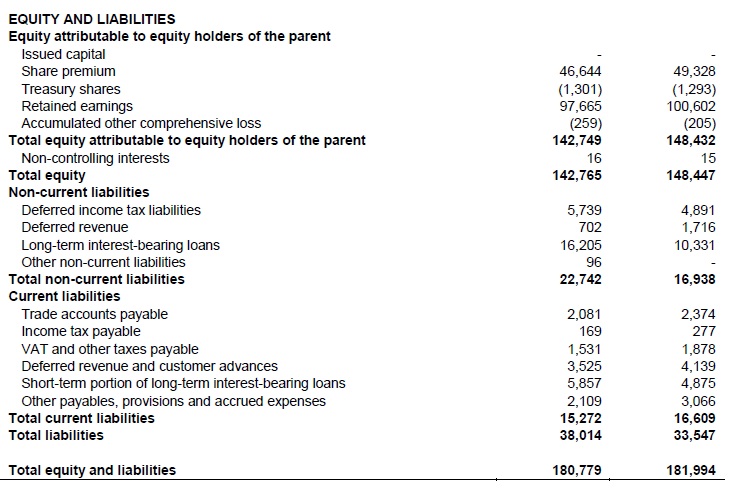

Unaudited Consolidated IFRS Statement of Financial Position

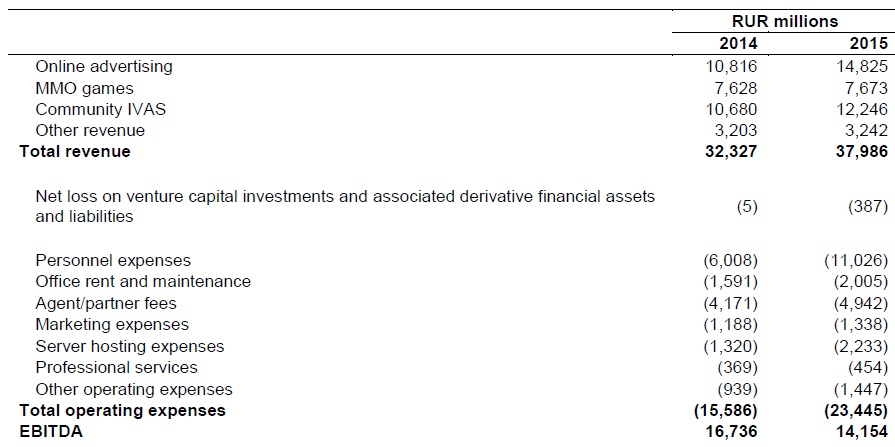

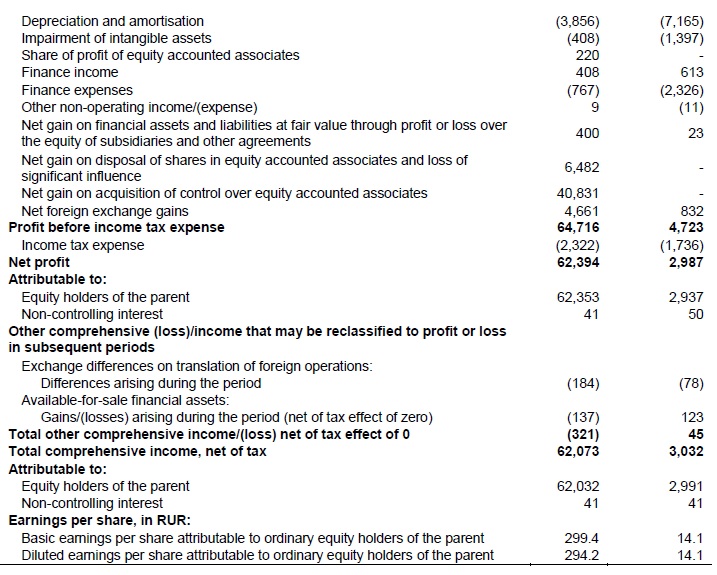

Unaudited Consolidated IFRS Statement of Comprehensive Income

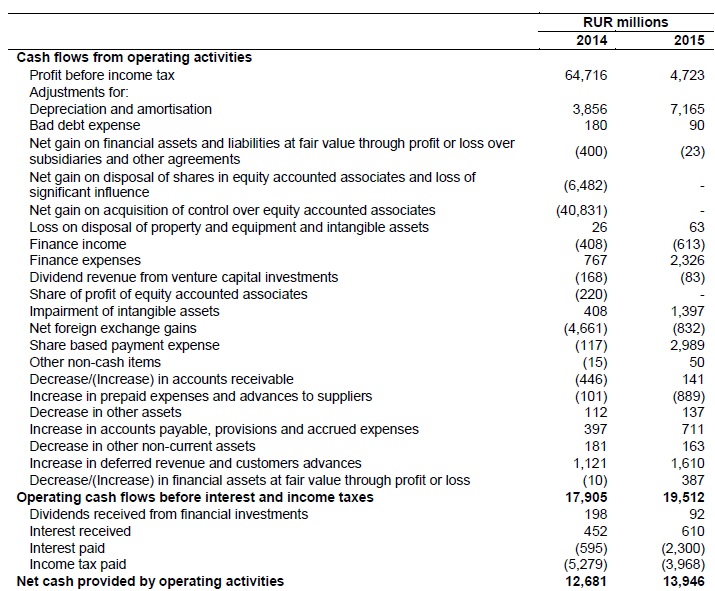

Unaudited Consolidated IFRS Statement of Cash Flows

Комментарии