Fujitsu Enables Fast Fintech for Nanto Bank with mBaaS Smartphone Application Service Platform

Smart Biz Connect for Finance, mBaaS based on FUJITSU Digital Business Platform MetaArc, enables financial institutions to implement smartphone application services from multiple vendors. Nanto Bank is the first Japanese regional bank to use mBaaS(4).

As a first step to begin delivering new smartphone application services, Nanto Bank will link Smart Biz Connect for Finance and an application from NetMove Corporation, then from March 2016, plans are to offer an Online-to-Offline(5) information-delivery service for users of IC-equipped combined cash and credit cards. Nanto Bank and NetMove are both members of the Fujitsu-sponsored fintech(6) consortium Financial Innovation For Japan (FIFJ), and today's announcement marks the first business deal between a financial institution and fintech company(7) to emerge from FIFJ.

Fujitsu, by provisioning Smart Biz Connect for Finance and sponsoring FIFJ, works to support the smooth deployment and expansion of fintech services in the financial industry.

Background

With the growing interest in fintech, Fujitsu has moved to accelerate open innovation in financial services by sponsoring FIFJ, a consortium comprised of a total of 164 of Japan's leading financial institutions and fintech companies, including Nanto Bank, NetMove, and others. While actively working to accelerate the development of financial services, Fujitsu has also been focusing its efforts on creating ICT platforms.

Nanto Bank decided to add new smartphone application services as part of its drive to expand customer financial services, and selected Smart Biz Connect for Finance as the platform, based on ease of deployment and operations, and future service expandability.

Smart Biz Connect for Finance Features and Deployment Benefits

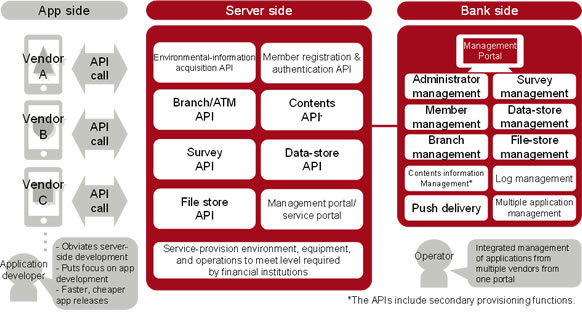

Smart Biz Connect for Finance comes with pre-built, cloud-based implementations of functions commonly needed for the development and provisioning of smartphone application services, including member registration and authentication and push notifications, which are available through an API(8), which means that this mBaaS open platform allows services to be built quickly and inexpensively while enabling integrated operations of multi-vendor smartphone applications.

1. Integrated management of multi-vendor smartphone applications, including fintech companies

Smart Biz Connect for Finance was developed on the premise that its financial institution customers would arrange to provide smartphone applications from multiple fintech companies and other vendors. This enables centralized, efficient operations and management of applications developed by multiple vendors from an operations portal.

2. Compliant with FISC's Security Guidelines on Computer Systems for Banking and Related Financial Institutions

As Smart Biz Connect for Finance is the only mBaaS open platform in Japan to comply with FISC's Security Guidelines on Computer Systems for Banking and Related Financial Institutions, financial institution customers can confidently deploy smartphone applications which handle users' personal information.

3. Minimizes build time and development, operations costs for smartphone application services

Smart Biz Connect for Finance implements as APIs many commonly used functions needed to build smartphone application services. Customers can use those APIs to customize applications or to connect to applications from fintech firms, while keeping development costs down and development times quick.

Building smartphone application services using Smart Biz Connect for Finance can save up to 70% in terms of development and operations cost as compared with not using mBaaS, and can speed up the development process by as much as 80%.

Outline of Smart Biz Connect for Finance

Outline of Smart Biz Connect for Finance

Future Developments

Fujitsu aims to deploy Smart Biz Connect for Finance to more than 40 financial institution customers over the next three years.

All company or product names mentioned herein are trademarks or registered trademarks of their respective owners. Information provided in this press release is accurate at time of publication and is subject to change without advance notice.

Комментарии