Mail.Ru Group Limited Preliminary Trading Update for Q3 2015

Q3 2015 Performance Highlights

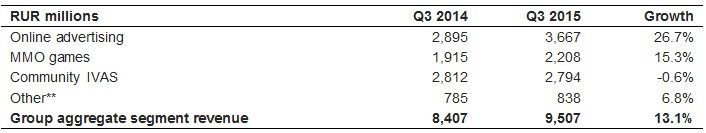

- Q3 2015 Group aggregate segment revenue grew 13.1% Y-o-Y to RUR 9,507 million (9 month 2015 Group aggregate segment revenue grew 8.9% Y-o-Y)

- Net debt position as of 30 September 2015 was RUR 9,897 million (excluding interest payable of RUR 112 million)

- Mail.Ru Group is the leading online property in Russia with 75.8 million monthly active users (comScore MMX Multi-Platform, Russia, age 6+, July 2015)

Key Recent Developments

- Worldwide launch of MMO game Armored Warfare

- myMail and Mail.Ru apps updated for iOS 9 with support of 3D touch, multitasking, search via Spotlight and universal links

- MAPS.ME updated iOS and Android apps with walking directions, new map style and enhanced car navigation

- MAPS.ME opened the source code of its applications

- ICQ moved to a new protocol that enables chat history synchronization across major desktop and mobile platforms and released app for Android with Material Design

- Cloud.Mail.Ru launched new online document editor based on Microsoft Office Online and introduced background upload option on iOS app

- VK launched a new service Market which allows group administrators to launch their own online stores within the social network

- VK updated apps for iOS and Android

- Native advertising in OK.RU newsfeed on desktop and mobile web

- Multiple updates of video, gaming and messaging services in OK.RU

- Mail.Ru Group launched Technotrack, a 2-year learning program focusing on mobile development, in collaboration with Moscow Institute of Physics and Technology

Commenting on the results of the Company, Dmitry Grishin, Chairman and CEO (Russia) of Mail.Ru Group, said:

In Q3 2015, the Company achieved revenue growth of 13.1% Y-o-Y to RUR 9,507 million. As in previous reported results the revenue growth rates are based on a full pro-forma consolidation of VK from the beginning of 2013.

With the ongoing economic and geo-political situation the overall operating environment in Q3 2015 remained somewhat challenging. However, as we commented with the H1 statement, we saw some stabilization in the advertising environment during Q2. This situation continued in Q3 where our advertising revenue grew 26.7% Y-o-Y. Targeted advertising, especially mobile and VK, saw strong growth rates and traction with both users and advertisers is strong. However, visibility has not improved and remains limited.

VK integration continues according to plan and the team continues to execute well. In Q3 VK revenues grew 55.4% Y-o-Y to RUR 1,505 million. As previously commented the focus for 2015 in VK will be the continued expansion of native advertising, especially on mobile, where we continue to see strong advertising interest and execution. With 9m revenue growth of 41.2% Y-o-Y we are very pleased with both engagement and execution. VK was acquired in the end of Q3 2014 and we started to improve monetisation from that point. The VK platform continues to represent a very significant opportunity.

Mobile continues to be a key focus. We commented with the H1 results that during Q2 the VK and OK.RU mobile daily audience exceeded desktop audience for the first time. This trend has continued in Q3 with continued strong growth in the mobile audience.

In Q3 our MMO revenues grew by 15.3% Y-o-Y. As scheduled, during Q3 Skyforge has started its international release and Armored Warfare went into full release in Europe, North America and Russia. The initial feedback on Armored Warfare has been very encouraging.

As we commented with the H1 results FX volatility and uncertainty are now affecting our ability to increase IVAS monetisation. As a result of this Q3 IVAS revenues declined 0.6% Y-o-Y to RUB 2,794 million. We remain focused on increasing user engagement and improving our product and increasing paying user penetration, especially in virtual gifts and services, as well as in our API platform.

While our other revenue stream grew by 6.8% Y-o-Y in Q3 it remains very sensitive to the underlying economic environment. As such we do not anticipate any near term improvements in this revenue stream.

Despite the continued challenging macro environment and FX headwinds we are pleased with the Q3 results. We are encouraged by the traction in advertising, especially on myTarget, and continue to see a number of exciting opportunities. Based on current visibility and current market conditions, we are pleased to re-iterate our FY 2015 guidance of revenue growth (including both VK and Headhunter on a pro-forma basis) to be between 7%-12% and FY EBITDA margins of between 47-48%.

Q3 2015 Trading Update*

(*) The numbers in this table and further in the document may not exactly foot or cross-foot due to rounding

(**) Including Other IVAS revenues

Note: Group aggregate segment revenue is calculated by aggregating the segment revenue of the Group's operating segments and eliminating intra-segment and inter-segment revenues. This measure differs in significant respects from IFRS consolidated net revenue. See "Presentation of Aggregate Segment Financial Information" below.

Liquidity

As of 30 September 2015, the Group had RUR 7,884 million of cash (including term deposits) and RUR 17,781 million of debt outstanding (excluding interest payable of RUR 112 million), therefore the Group's net debt position was RUR 9,897 million, or USD 149 million [1].

Conference call

The Mail.Ru Group management team will host an analyst and investor conference call at 09.00 UK time (11.00 Moscow time), on Thursday 22 October 2015, including a Question and Answer session.

Cautionary Statement regarding Forward Looking StatementsThis press release contains statements of expectation and other forward-looking statements regarding future events or the future financial performance of the Group. You can identify forward looking statements by terms such as "expect", "believe", "anticipate", "estimate", "forecast", "intend", "will", "could", "may" or "might", the negative of such terms or other similar expressions including "outlook" or "guidance". The forward-looking statements in this release are based upon various assumptions that are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and may be beyond the Group's control. Actual results could differ materially from those discussed in the forward looking statements herein. Many factors could cause actual results to differ materially from those discussed in the forward looking statements included herein, including competition in the marketplace, changes in consumer preferences, the degree of Internet penetration and online advertising in Russia, concerns about data security, claims of intellectual property infringement, adverse media speculation, changes in political, social, legal or economic conditions in Russia, exchange rate fluctuations, and the Group's success in identifying and responding to these and other risks involved in its business, including those referenced under "Risk Factors" in the Group's public filings. The forward-looking statements contained herein speak only as of the date they were made, and the Group does not intend to amend or update these statements except to the extent required by law to reflect events and circumstances occurring after the date hereof.

About Mail.Ru Group

Mail.Ru Group (LSE: MAIL, listed since November 5, 2010) is a leading company in the Russian-speaking Internet markets (Russia is Europe's largest Internet market measured by the number of users, comScore). Mail.Ru Group's sites reach approximately 96% of Russian Internet users on a monthly basis (comScore, June 2015) and the Company is the sixth largest Internet business globally, based on the total time spent (comScore, June 2015).

In line with the ‘communitainment’ (communication plus entertainment) strategy, the Company is moving rapidly to build an integrated communications and entertainment platform. The Company owns Russia’s leading email service and one of Russia’s largest internet portals, Mail.Ru (TNS, all Russia, age 12-64, June 2015); three major Russian language social networks, Vkontakte (VK), Odnoklassniki (OK.RU) and Moi Mir (My World); and Russia’s largest online games business. Our portfolio also includes a leading OpenStreetMap-based offline mobile maps and navigation service MAPS.ME and two instant messaging (IM) services, Mail.Ru Agent and ICQ, popular in Russia and CIS.

The Company holds minority equity stakes in Qiwi (1.31%) and a number of small venture capital investments in various Internet companies in Russia, Ukraine and Israel.

[1] The USD number represents a convenience translation. The RUR amounts have been translated into USD using an exchange rate of RUR 66.2367 to USD 1.00, the official exchange rate quoted as of September 30, 2015 by the Central Bank of the Russian Federation

Комментарии