Vanguard: Expense ratios reflect commitment to low costs

During the six months ended May 31, Vanguard announced changes to the expense ratios of 68 mutual funds and ETFs available to institutional and retirement plan investors. Of those that changed, the expense ratios of 55 investments went down. The impact of these changes depends on an investor's holdings in the affected funds but in the aggregate they represent savings of millions of dollars to investors per year.

In June, Vanguard lowered costs even further by launching 12 Institutional Target Retirement Funds with estimated expense ratios of 10 basis points each.

"Our commitment to keeping costs low and returning value to investors is constant and can be especially important to plan fiduciaries, who need to assess the reasonableness of investment costs," said Martha King, managing director of Vanguard Institutional Investor Group. "It's one reason we continually seek efficiencies as we look to return even more value to plan sponsors and participants."

Costs in the rearview mirror

Expense ratios are reviewed annually and adjusted up or down to reflect changes in the cost of managing the funds. U.S. Securities and Exchange Commission rules require that investment companies calculate expense ratios based on actual incurred expenses during each fund's most recently completed fiscal year. Vanguard's standard cycle of expense ratio updates, reported in annual prospectus updates, occurs from December through May each year.

In most cases, expense ratios are backward-looking and serve as an estimate of future expenses. When a new fund is launched or an existing fund makes changes that are expected to affect costs—such as a change in its investment advisor structure—estimated forward-looking expense ratios are used.

There are many reasons costs can change. For example, economies of scale resulting from an increase in a fund's total assets because of cash flow or market appreciation can help reduce its expense ratio. Increased trading costs and complexity or declining assets can result in increases. In actively managed funds, a portfolio manager who beats a benchmark may earn a performance bonus, which is then reflected in the expense ratio.

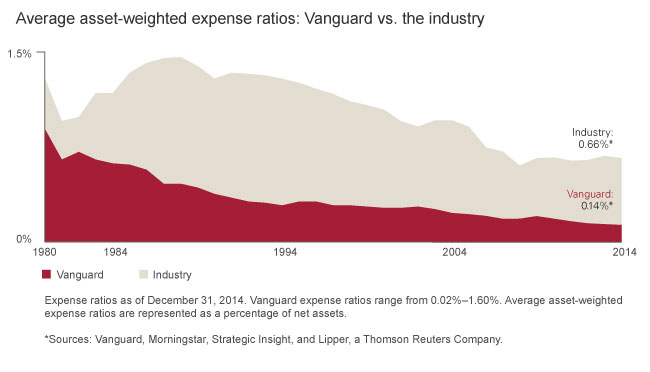

Over the long term, the trend in costs has been downward across the industry and at Vanguard. In 2014, the asset-weighted average expense ratio for Vanguard funds was 14 basis points, compared with the industry's average asset-weighted expense ratio of 66 basis points, as shown in the chart below.

Scale and structure help drive costs lower

Scale has been an important factor in Vanguard's ability to lower costs, as assets under management have increased to more than \\$3.1 trillion as of May 31, 2015, from \\$2.5 trillion in January 2014. Larger scale allows for cost efficiencies in investment management, administration, and shareholder support services.

Size is not the only factor, however. Vanguard's record of reducing costs is an outgrowth of the firm's unique ownership structure. Vanguard is owned by the Vanguard funds, which, in turn, are owned by their shareholders. Vanguard provides its services to the funds at cost.

"We spend modest amounts on marketing relative to competitors, we don't pay third parties to distribute our funds, and we negotiate favorable fee arrangements with our external investment advisors," Ms. King said. "All of this helps to result in significant cost savings for our clients over time."

Notes:

- Vanguard ETF Shares are not redeemable with the issuing fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

- Investments in Vanguard Institutional Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund or trust name refers to the approximate year (the target date) when an investor in the fund or trust would retire and leave the workforce. The fund or trust will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. An investment in an Institutional Target Retirement Fund is not guaranteed at any time, including on or after the target date.

- All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss.

- There are significant differences between investments and expense ratio is only of them.

Комментарии