Mail.Ru Group Limited Final audited IFRS results for FY 2014 and preliminary revenue update for Q1 2015

Performance highlights

- Final audited segment results for FY 2014 are consistent with the

preliminary trading statement

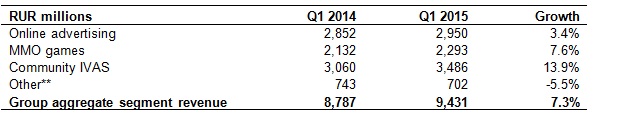

– Group aggregate segment revenue at RUR 35,778m, Group aggregate segment EBITDA at RUR 18,297m, Group aggregate net profit at RUR 12,518m - Q1 2015 Group aggregate segment revenue grew 7.3% Y-o-Y to RUR 9,431m

- Net debt position as of 31 March 2015 was RUR 14,889 million (excluding interest payable of RUR 137 million)

Key Recent Developments

- Launch of myTarget, an advertising platform that combines the mobile audience of VK, OK.RU and My World

- Internally developed MMORPG Skyforge launched in Russia

- Legacy of Dominion, a major update of mobile game Evolution: Battle for Utopia

- Major update of Warface including improved interface, new weapons and outfits, additional maps for Player vs. Player mode, new Player vs. Environment mission Marathon

- MAPS.ME introduced ability to build routes between different regions and countries (iOS and Android) and updated maps with additional data on point of interest (Android)

- myMail and Mail.Ru email apps for iOS support Apple Watch, preserve HTML format (on reply/forward), feature message themes, filters within each folder and additional security options; Android apps redesigned with Android L Material Design

- Cloud.Mail.Ru introduced paid storage plans that expand storage space up to 4 TB

- OK.RU updated iOS app with in-app browser for external links and quick photo picker; Android app redesigned with Android L Material Design

- Detailed statistics on posts for group administrators in VK

- New VK app for Windows Phone with new design and multiple updates

- ICQ for Android offers extended privacy features, supports Android 5 and Android Auto; ICQ for iOS updated with new UI of audio and video calls

- Mail.Ru Agent for iOS updated with faster file sending, better image quality

Commenting on the results of the Company, Dmitry Grishin, Chairman and CEO (Russia) of Mail.Ru Group, said:

“We are pleased to report our final IFRS audited results for 2014 which are in line with the preliminary announcement in February. Despite the continuing challenging macro and geo-political environment, which remained broadly unchanged, we have started 2015 with a solid Q1 performance. In Q1 2015, the Company achieved aggregate segment revenue growth of 7.3% Y-o-Y to RUR 9,431 million. As in the FY 2014 reported results the revenue growth rates are based on a full pro-forma consolidation of VK from the beginning of 2013.

In Q1 2015 our MMO games and community IVAS revenues remained broadly on budget, but advertising revenues, particularly in display, and our HeadHunter business continued to face difficult conditions as a result of the ongoing economic and geo-political environment. However we continue to focus on the opportunities presented by both mobile and video advertising across the entire network. We are pleased with the launch of the myTarget platform which continues the integration of VK into the wider group. In Q1 VK revenues grew 27.5% to RUR 1,286 million. As previously commented the focus for 2015 in VK will be the continued expansion of video and mobile advertising. This was started in Q4 2014 and traction continued to grow in Q1 and we are pleased with the progress. VK continues to make good progress and in January 2015 set an all time record with 5.56m registrations.

Our other revenue stream remains sensitive to the underlying economic environment and hence saw revenues decline by 5.5% in Q1. The sale of HeadHunter did not close and the process has been terminated, and as such, we continue to operate HeadHunter as a part of the Company.

In Q1 we continued to execute on our MMO games strategy which proved successful over the last years. Warface remains our largest revenue generating game with continued strong performance and also benefited from further updates. During Q1 Skyforge successfully completed its closed beta release and has subsequently gone into full release in Russia. International release will follow later this year. Initial feedback on the game has been encouraging. The pipeline remains strong with Armored Warfare due to go into closed beta in H1 and World of Speed potentially in H2. As previously commented, we will also continue to internationalise our most successful titles under the My.com brand. Therefore we expect the MMO games revenues to show solid growth through 2015.

Community IVAS revenues showed solid growth in Q1, growing ahead of the increase in the user base as we continue to focus on increasing paying user penetration – especially in virtual gifts and services, as well as in our API platform. We remain focused on increasing user engagement and improving our product.

Our international expansion continues and we remain encouraged by the traction of myMail which continued to gain traction in Q1. The US is the largest market followed by the UK, France, Germany and Brazil. We will look to leverage the myMail user base through the international release of games later this year.

We are pleased to announce that both the board and shareholders have now approved the new long-term incentive plan based around restricted stock units. Our team remains our most valuable asset and the retention of engineering talent is key to the long term success of the Company.

We have had a solid start to the year and our engagement with users remains very strong, and user behavior remains unchanged. While we see no near term change to the underlying environment in Russia international initiatives under the my.com brand are going well, and we continue to see a number of opportunities both in VK, and in our games business. Based on current visibility and current market conditions, we are pleased to re-iterate our FY 2015 guidance of revenue growth (including both VK and HeadHunter on a pro-forma basis) to be between 7%-12% with EBITDA margins at between 46-47%.”

Conference call

The management team will host an analyst and investor conference call at 09.00 UK time (11.00 Moscow time), on Thursday 23 April 2015, to discuss details of the Company’s performance and certain forward-looking information. The conference call will include a Question and Answer session.

To participate in this conference call, please use the following access details:

Confirmation Code: 25288176

Participant Toll Free Telephone Numbers:

Russia Free Phone 810

800 209 72044

UK Free Phone 080

0694 0257

USA Free Phone 1866

966 9439

For Further Information Please Contact:

Investors

Matthew Hammond

Email: hammond@corp.mail.ru

Press

Irina Solenaya

Email: solenaya@corp.mail.ru

Cautionary Statement regarding Forward Looking Statements

This press release contains statements of expectation and other forward-looking statements regarding future events or the future financial performance of the Company. You can identify forward looking statements by terms such as "expect", "believe", "anticipate", "estimate", "forecast", "intend", "will", "could", "may" or "might", the negative of such terms or other similar expressions including "outlook" or "guidance". The forward-looking statements in this release are based upon various assumptions that are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and may be beyond the Company's control. Actual results could differ materially from those discussed in the forward looking statements herein. Many factors could cause actual results to differ materially from those discussed in the forward looking statements included herein, including competition in the marketplace, changes in consumer preferences, the degree of Internet penetration and online advertising in Russia, concerns about data security, claims of intellectual property infringement, adverse media speculation, changes in political, social, legal or economic conditions in Russia, exchange rate fluctuations, and the Company's success in identifying and responding to these and other risks involved in its business, including those referenced under "Risk Factors" in the Company's public filings. The forward-looking statements contained herein speak only as of the date they were made, and the Company does not intend to amend or update these statements except to the extent required by law to reflect events and circumstances occurring after the date hereof.

About Mail.Ru Group

Mail.Ru Group (LSE:MAIL, listed since November 5, 2010) is a leading company in the Russian-speaking Internet markets (Russia is Europe's largest Internet market measured by the number of users, comScore). Mail.Ru Group's sites reach approximately 96% of Russian Internet users on a monthly basis (comScore, December 2014) and the Company is the sixth largest Internet business globally, based on the total time spent (comScore, December 2014).

In line with the ‘communitainment’ (communication plus entertainment) strategy, the Company is moving rapidly to build an integrated communications and entertainment platform. The Company owns Russia’s leading email service and one of Russia’s largest internet portals, Mail.Ru (TNS, all Russia, age 12-64, December 2014); three major Russian language social networks, Vkontakte (VK), Odnoklassniki (OK.RU) and Moi Mir (My World); and Russia’s largest online games business. Our portfolio also includes a leading OpenStreetMap-based offline mobile maps and navigation service MAPS.ME and two instant messaging (IM) services, Mail.Ru Agent and ICQ, popular in Russia and CIS.

The Company holds minority equity stakes in Qiwi (1.31%) and a number of small venture capital investments in various Internet companies in Russia, Ukraine and Israel.

Current Trading Update*

(*) The numbers in this table and

further in the document may not exactly foot or cross-foot due to rounding

(**) Including

Other IVAS revenues

Note: Group

aggregate segment revenue is calculated by aggregating the segment revenue of

the Company's operating segments and eliminating intra-segment and

inter-segment revenues. This measure differs in significant respects from IFRS

consolidated net revenue. See "Presentation of Aggregate Segment Financial

Information" below.

Liquidity

As of 31 March 2015, the Group had RUR 5,710 million of cash (including term deposits) and RUR 20,598 million of debt outstanding (excluding interest payable of RUR 137 million), therefore the Group's net debt position was RUR 14,889 million, or USD 255 million [1].

Filing of the Annual Report for 2014

The Company’s Annual Report and audited consolidated financial statements for the year ended December 31, 2014 prepared in accordance with IFRS and accompanied by an independent auditor’s report have been filed on the National Storage Mechanism appointed by the Financial Services Authority and can be accessed at https://corp.mail.ru/media/files/mail.rugrouparfy2014.pdf

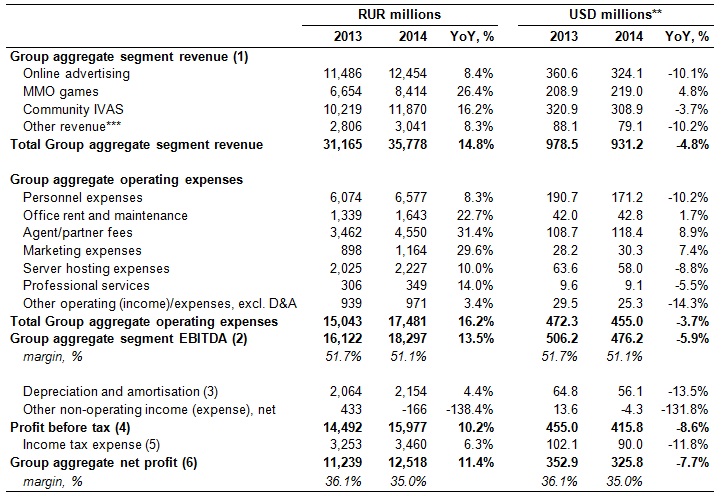

Group aggregate segment financial information*

(*) The numbers

in this table and further in the document may not exactly foot or cross-foot

due to rounding

(**) The

USD numbers for FY 2013 and FY 2014 represent a convenience

translation.

The

RUR amounts have been translated into USD using average exchange rates for

FY 2013 (31.8480 RUR/USD) and FY 2014 (38.4217 RUR/USD) respectively

(***) Including

Other IVAS revenues

(1) Group aggregate segment revenue is calculated by aggregating the segment revenue of the Company's operating segments and eliminating intra-segment and inter-segment revenues. This measure differs in significant respects from IFRS consolidated net revenue. See "Presentation of Aggregate Segment Financial Information" below.

(2) Group aggregate segment EBITDA is calculated by subtracting Group aggregate segment operating expenses from Group aggregate segment revenue. Group aggregate segment operating expenses are calculated by aggregating the segment operating expenses (excluding the depreciation and amortisation) of the Company's operating segments including allocated Group corporate expenses, and eliminating intra-segment and inter-segment expenses. See "Presentation of Aggregate Segment Financial Information".

(3) Group aggregate depreciation and amortisation expense is calculated by aggregating the depreciation and amortisation expense of the subsidiaries consolidated as of the date hereof, excluding amortisation and impairment of fair value adjustments to intangible assets acquired in business combinations.

(4) Profit before tax is calculated by deducting from Group aggregate segment EBITDA Group aggregate depreciation and amortisation and adding/deducting Group aggregate other non-operating incomes/expenses primarily consisting of interest income on cash deposits, interest expenses, dividends from financial and available-for-sale investments and other non-operating items.

(5) Group aggregate income tax expense is calculated by aggregating the income tax expense of the subsidiaries consolidated as of the date hereof. Group aggregate income tax expense is different from income tax as would be recorded under IFRS, as (i) it excludes deferred tax on unremitted earnings of the Company's subsidiaries and (ii) it is adjusted for the tax effect of differences in profit before tax between Group aggregate segment financial information and IFRS.

(6) Group aggregate net profit is the (i) Group aggregate segment EBITDA; less (ii) Group aggregate depreciation and amortisation expense; less (iii) Group aggregate other non-operating expense; plus (iv) Group aggregate other non-operating income; less (v) Group aggregate income tax expense. Group aggregate segment net profit differs in significant respects from IFRS consolidated net profit. See "Presentation of Aggregate Segment Financial Information".

Operating Segments

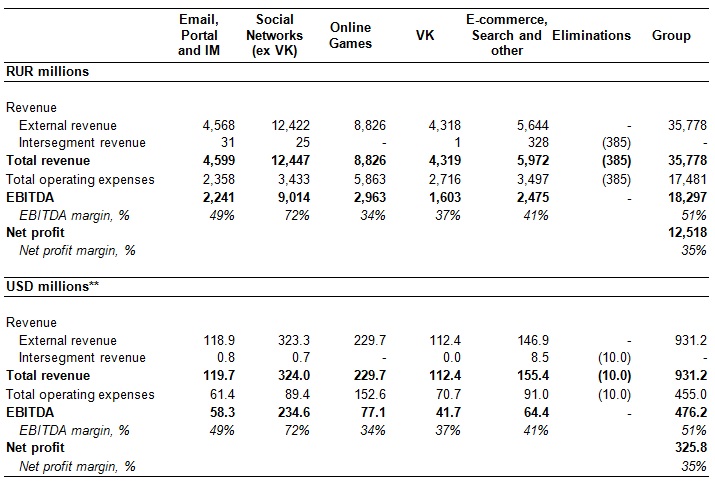

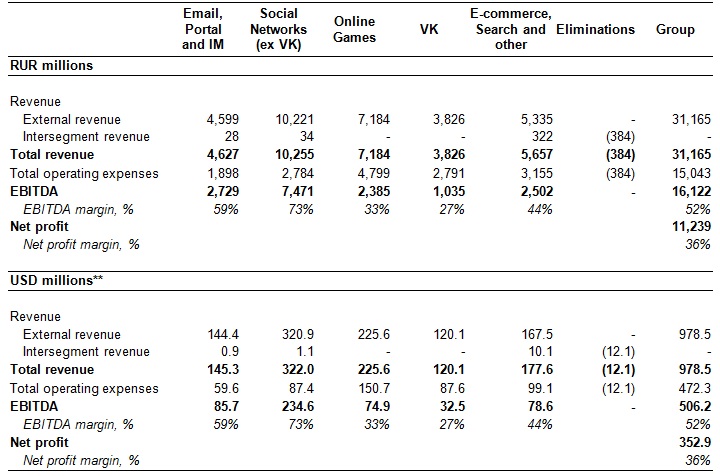

We identify our operating segments based on the types of products and services we offer. We have identified the following reportable segments on this basis:

- Email, Portal and IM;

- Social Networks (excluding VK);

- Online Games;

- VK; and

- E-Commerce, Search and Other Services

The Email, Portal and IM segment includes email, instant messaging and portal (main page and verticals). It earns almost all revenues from display and context advertising.

The Social Networks (excluding VK) segment includes our two social networks (OK.RU and My World) and earns revenues from (i) user payments for virtual gifts, (ii) revenue sharing with application developers, and (iii) online advertising, including display and context advertising.

The Online Games segment includes online gaming services, including MMO, social and mobile games. It earns almost all revenues from (i) sale of virtual in-game items to users and (ii) royalties for games licensed to third-party online game operators.

The VK segment includes the Group’s social network Vkontakte (VK.com) and earns revenues from (i) commission from application developers based on the respective applications’ revenue, (ii) user payments for virtual gifts and stickers, and (iii) online advertising, including display and context advertising.

The E-Commerce, Search and Other Services segment primarily consists of search engine services earning almost all revenues from context advertising, e-commerce and online recruitment services and related display advertising. This segment also includes a variety of other services, which management considers insignificant for the purposes of performance review and resource allocation.

Each segment's EBITDA is calculated as the respective segment's revenue less operating expenses (excluding depreciation and amortisation and impairment of intangible assets), including our corporate expenses allocated to the respective segment.

Operating Segments Performance –FY 2014*

(*) The numbers

in this table and further in the document may not exactly foot or cross-foot

due to rounding

(**) The USD numbers represent a convenience translation. The RUR amounts have been translated into USD using FY 2014

average exchange rate of

38.4217 RUR/USD

Operating Segments Performance – FY 2013*

(*) The numbers

in this table and further in the document may not exactly foot or cross-foot

due to rounding

(**) The USD numbers represent a convenience translation. The RUR amounts have been translated into USD using FY 2013

average exchange rate of 31.8480 RUR/USD

2014 results summary

A full discussion of the Company’s 2014 results is presented on pages 27-38 of the Company’s 2014 Annual Report available for download at https://corp.mail.ru/media/files/mail.rugrouparfy2014.pdf

Presentation of Aggregate Segment Financial Information

The Group aggregate segment financial information is derived from the financial information used by management to manage the Company's business by aggregating the segment financial data of the Company's operating segments and eliminating intra-segment and inter-segment revenues and expenses. Group aggregate segment financial information differs significantly from the financial information presented on the face of the Company's consolidated financial statements in accordance with IFRS. In particular:

- The Company's segment financial information excludes certain IFRS adjustments which are not analysed by management in assessing the core operating performance of the business. Such adjustments affect such major areas as revenue recognition, deferred tax on unremitted earnings of subsidiaries, share-based payment transactions, disposal of and impairment of investments, business combinations, fair value adjustments, amortisation and impairment thereof, net foreign exchange gains and losses, share in financial results of associates, as well as irregular non-recurring items that occur from time to time and are evaluated for adjustment as and when they occur. The tax effect of these adjustments is also excluded from segment reporting.

- The segment financial information is presented for each period on the basis of an ownership interest as of the date hereof and consolidation of each of the Company's subsidiaries, including for periods prior to the acquisition of control of the entities in question, so long as the Company held at least one share of such entities during such periods. The financial information of subsidiaries disposed of prior to the date hereof is excluded from the segment presentation starting from the beginning of the earliest period presented.

- Segment revenues do not reflect certain other adjustments required when presenting consolidated revenues under IFRS. For example, segment revenue excludes barter revenues and adjustments to defer online gaming and social network revenues under IFRS.

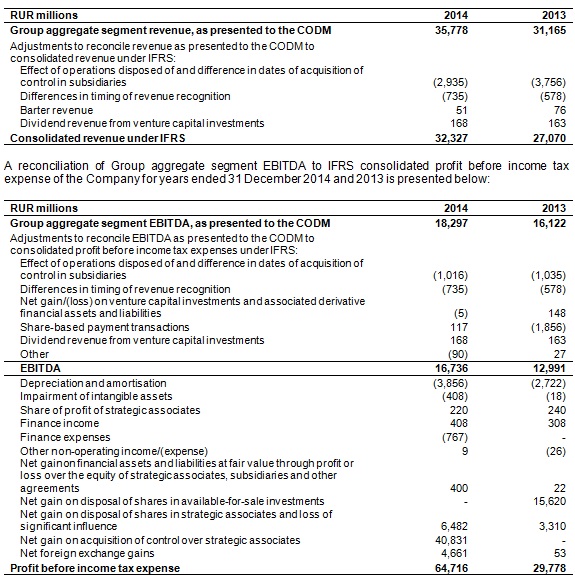

A reconciliation of Group aggregate segment revenue to IFRS consolidated revenue of the Company for the years ended 31 December 2014 and 2013 is presented below:

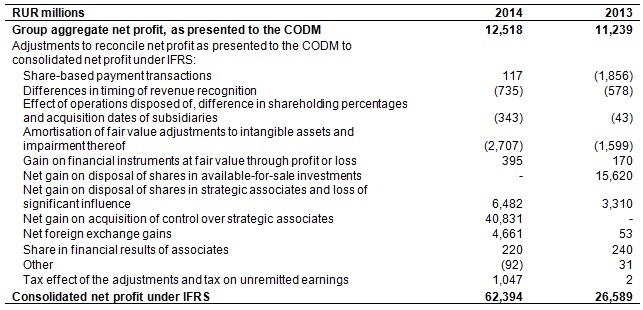

A reconciliation of Group aggregate net profit to IFRS consolidated net profit of the Company for the years ended 31 December 2014 and 2013 is presented below:

[1] The USD number represents a convenience translation. The RUR amounts have been translated into USD using an exchange rate of RUR 58.4643 to USD 1.00, the official exchange rate quoted as of March 31, 2015 by the Central Bank of the Russian Federation

Комментарии